Person liable for registration under GST.

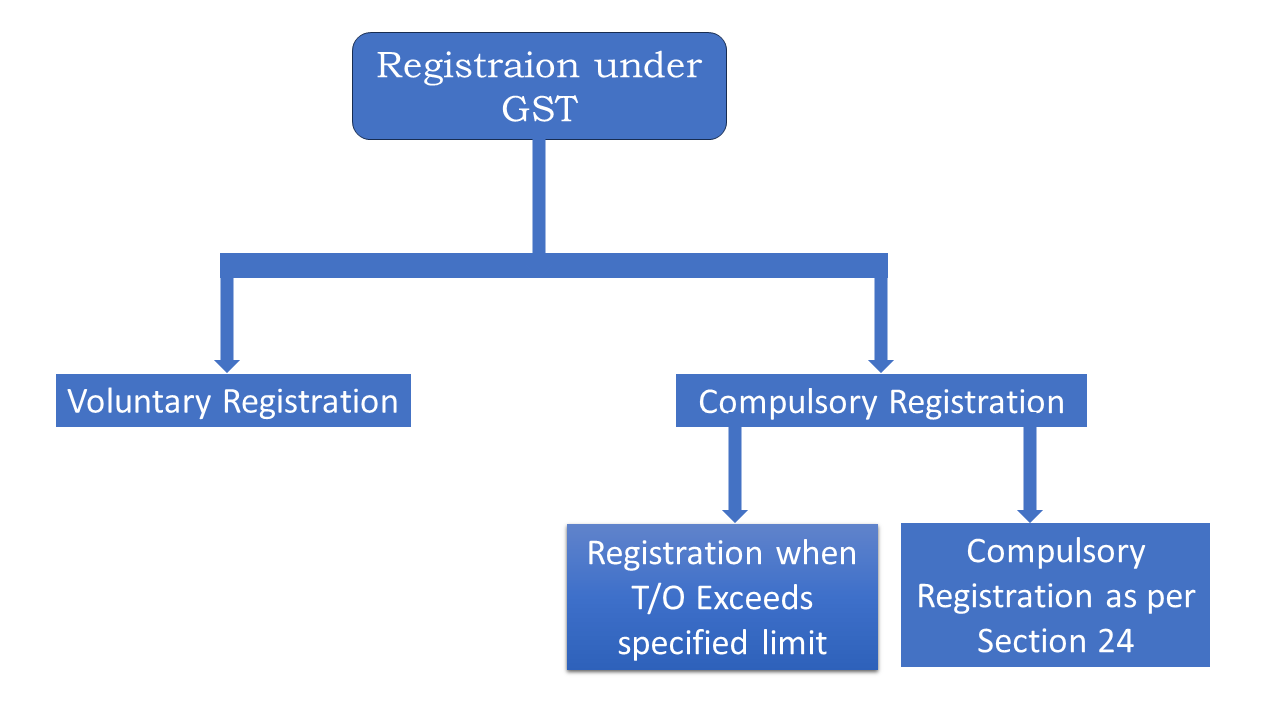

Every supplier is required to take GST registration whose aggregate turnover in a financial year exceeds the specified turnover limit.

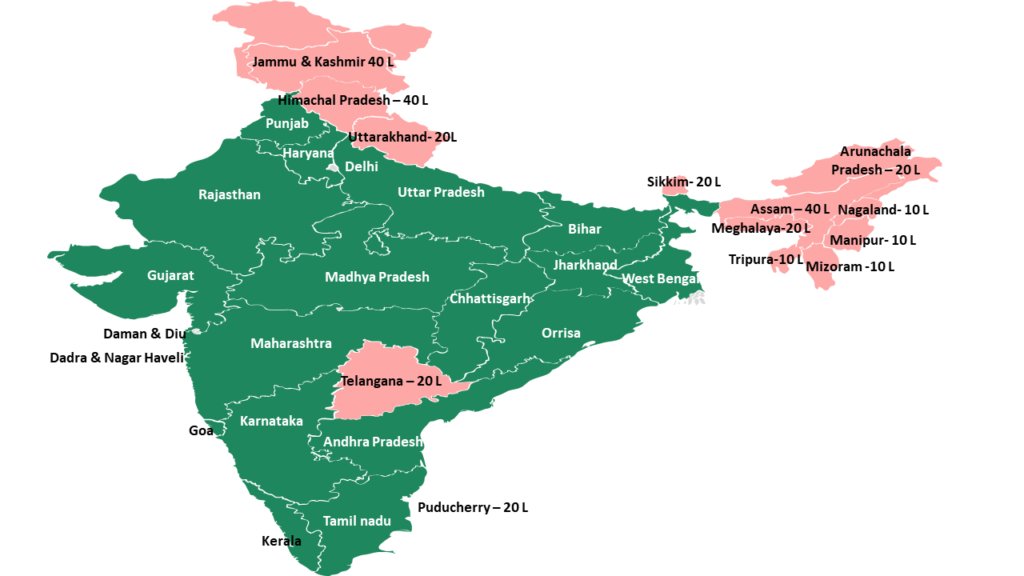

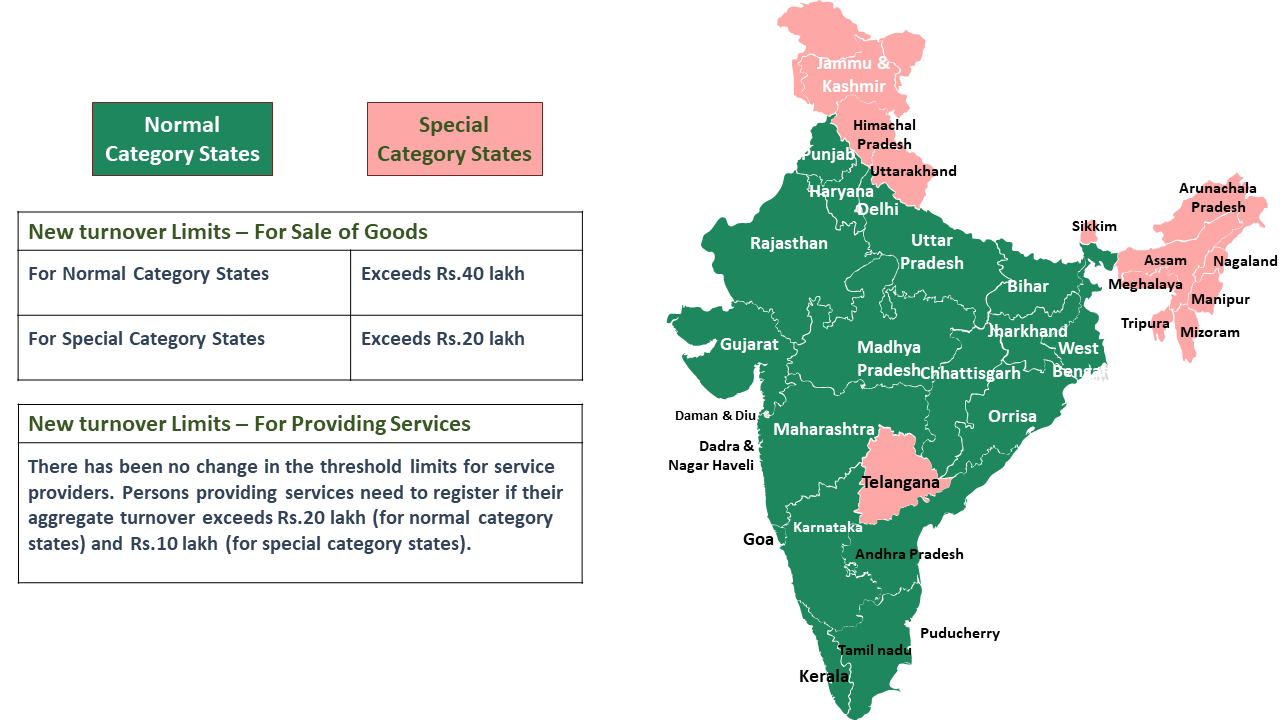

Different turnover limits are specified for different states based on categories.

Turnover limits of Rs. 10 Lakhs

Turnover limits of Rs. 20 Lakhs

Turnover limits of Rs. 40 Lakhs

Note: 1) Of the above special category states Assam, follow the Rs.40 lakh threshold limit for GST registration and not 20 Lakhs

2) Union Territory of Puducherry also follows the threshold limit of Rs.20 lakh.

There has been no change in the threshold limits for service providers. Persons providing services need to register if their aggregate turnover exceeds Rs.20 lakh (for normal category states) and Rs.10 lakh (for special category states).

Aggregate turnover limit of GST registration Applicable from 01/04/2019

Name of State

01-07-2017 to 31-01-2019

02-09-2017 to 31-03-2019

From 01-04-2019

Manipur, Mizoram,

Nagaland & Tripura

(Special Category states)

₹10 Lakhs

(Special Category states)

₹10 Lakhs

(Special Category states)

₹10 Lakhs

Sikkim, Arunachal Pradesh

(Special Category states)

₹10 Lakhs

(Normal Category states)

₹20 Lakhs

(Normal Category states)

₹20 Lakhs

Assam

(Special Category states)

₹10 Lakhs

(Normal Category states)

₹20 Lakhs

(Normal Category states)

₹40 Lakhs

Jammu and Kashmir

(Special Category states)

₹10 Lakhs

(Normal Category states)

₹20 Lakhs

(Normal Category states)

₹40 Lakhs

Puducherry,

Telangana

(Normal Category states)

₹20 Lakhs

(Normal Category states)

₹20 Lakhs

(Normal Category states)

₹20 Lakhs

Rest of India

(Normal Category states)

₹20 Lakhs

(Normal Category states)

₹20 Lakhs

(Normal Category states)

₹40 Lakhs

Aggregate turnover limit of GST registration Applicable from 01/04/2019

Name of State

Nagaland & Tripura

(Special Category states)

₹10 Lakhs

Sikkim, Arunachal Pradesh

(Normal Category states)

₹20 Lakhs

(Normal Category states)

₹40 Lakhs

(Normal Category states)

₹40 Lakhs

(Normal Category states)

₹20 Lakhs

(Normal Category states)

₹40 Lakhs