Facility of enrolment to supplier who Supply of goods through e-commerce operators by GST un-registered suppliers

As per recent amendments to the Act and the rules and notification number 34/2023 dated 31/07/2023, persons supplying goods through e-commerce operators shall be exempt from mandatory registration under the CGST Act even if they supply goods through e-commerce operators (ECO) if they satisfy the specified conditions which are given as follows:

a) Such person is engaged in the supply of goods through the ECO and such supplies are made only in one State/UT,

b) such person does not make any inter-state supply

c) The said person has a Permanent Account Number (PAN) under the Income Tax Act, 1961,

d)such persons shall declare his PAN (which shall be validated) on the common portal (i.e. GST Portal) along with the address

of his place of business and the name of the State/UT or Union territory before making such supplies,

e)such person has been granted an enrolment number on the common portal upon validation of his PAN before which he shall not make any such supply through any ECO.

GSTN has introduced Facility of enrolment to supplier who Supply of goods through e-commerce operators by GST un-registered suppliers which given as follows:

How un-registered supplier can get registered on GST Portal.

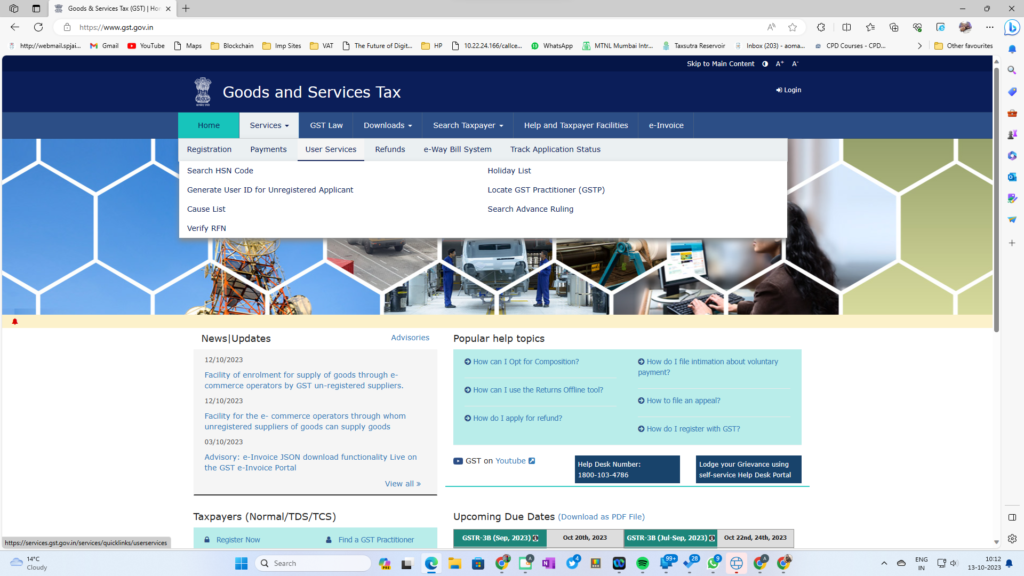

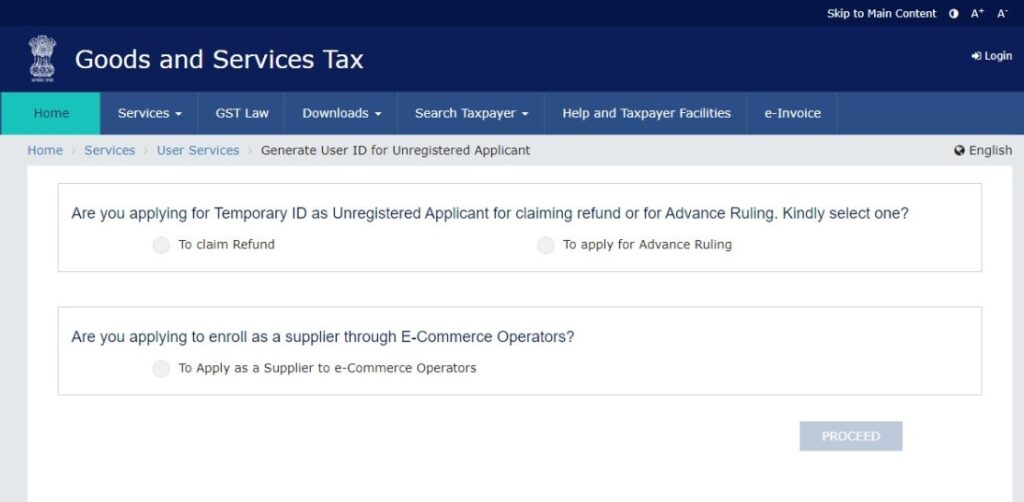

Type GST Portal name https://www.gst.gov.in/ and click on "User Services".

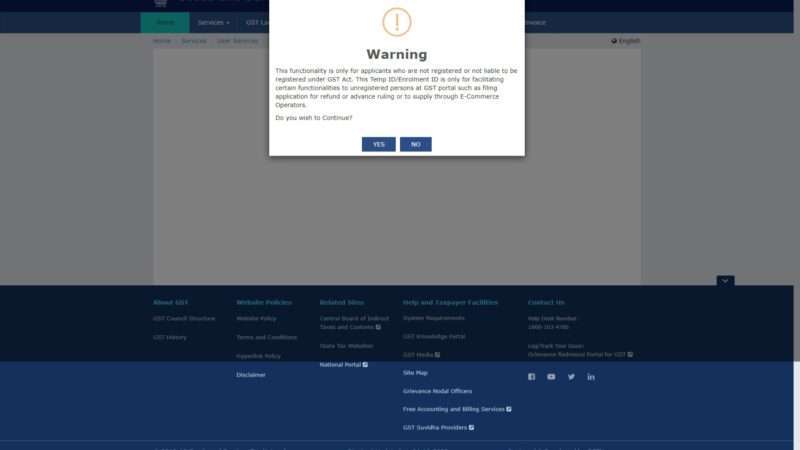

Click on “Yes” on the Warning window which asks you to Continue

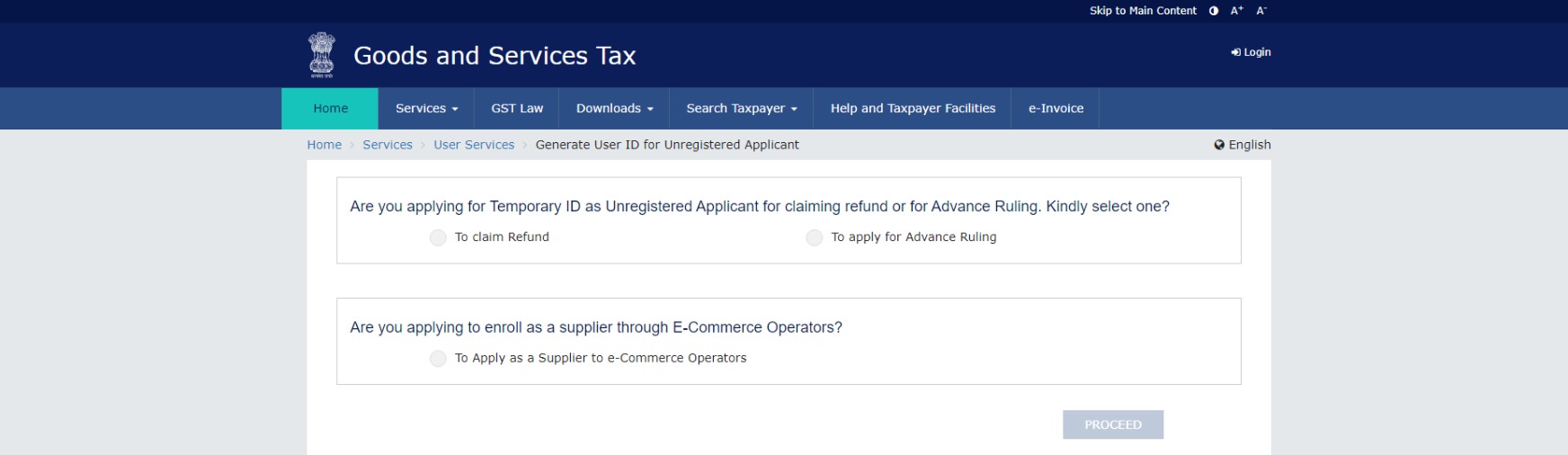

Click on “To apply as a supplier to e commerce operators” box and click on Proceed

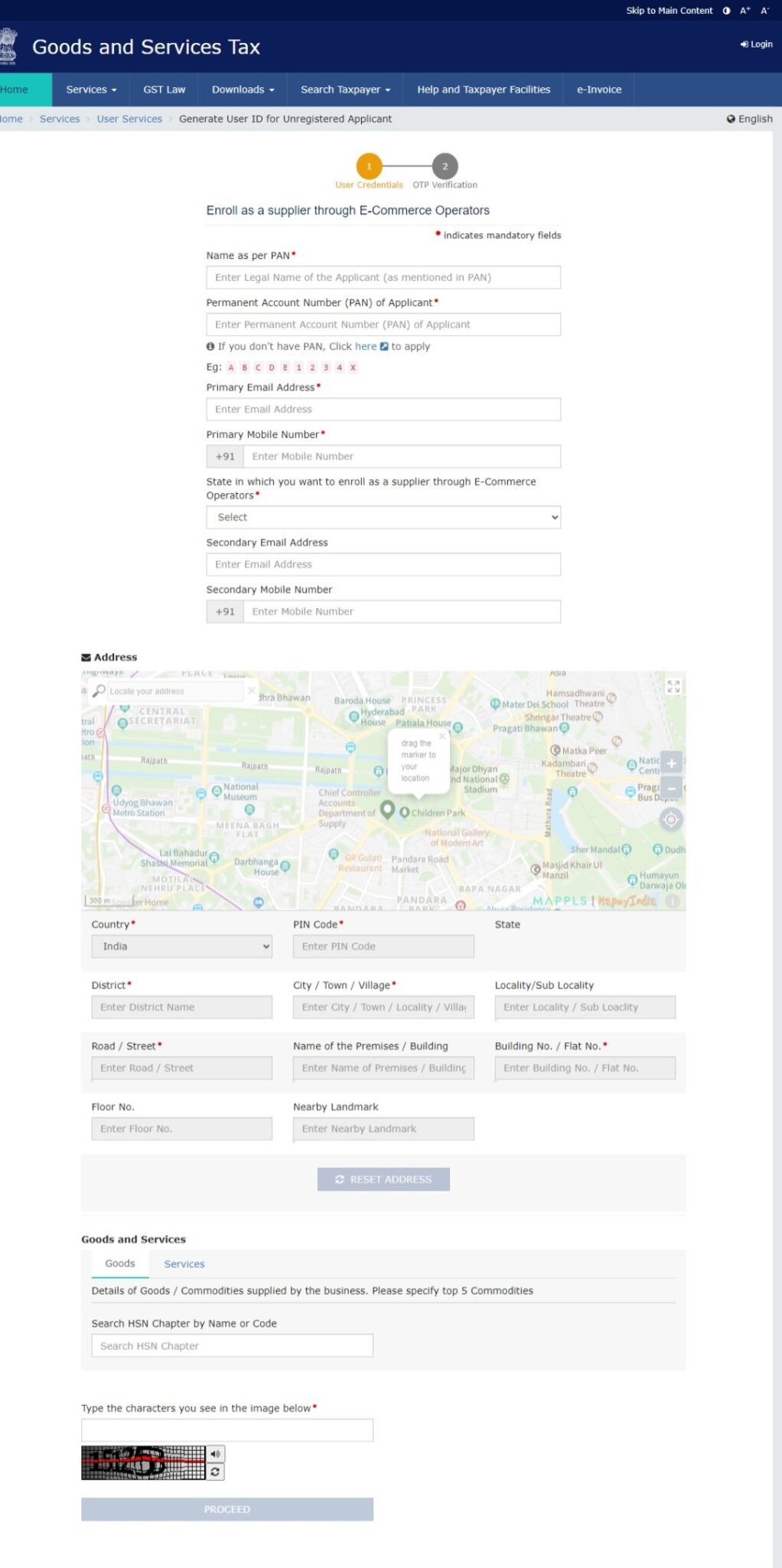

Proceed to fill the Form that opens on your screen