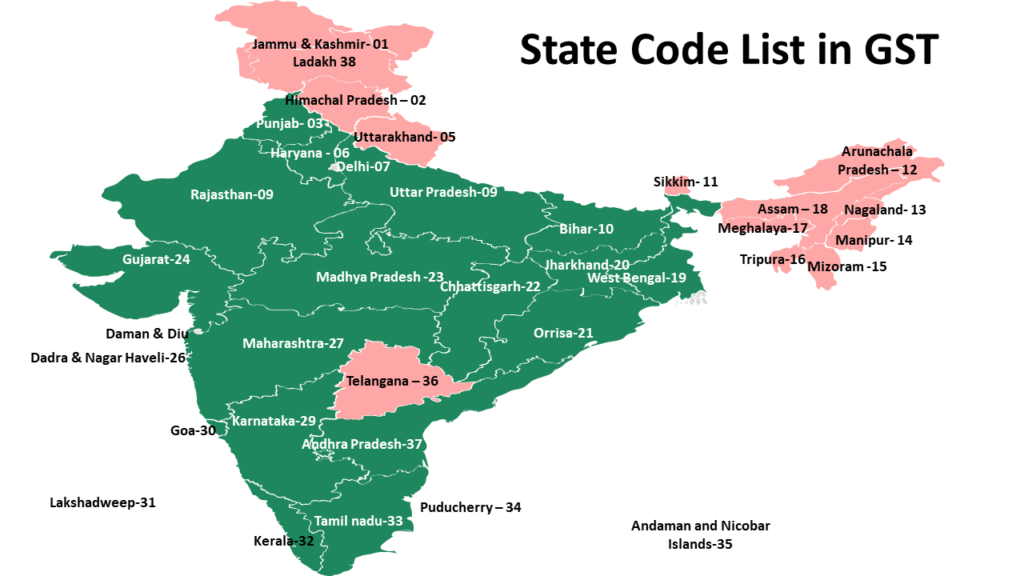

What is the GST State Code?

The first two digits of 15 alphanumeric GST number is State code. This code represents the state or Union Territory where business is registered. Normally temporary state code is issued for 7 days while registering a business under GST. After that, a permanent state code will be allotted to you.

For example, 03 GST State code in 03AAJCR2207E1Z2 represents a business registered under GST in Punjab.

| States | GST State Code | Alpha Code |

|---|---|---|

| Jammu & Kashmir | 01 | JK |

| Himachal Pradesh | 02 | HP |

| Punjab | 03 | PB |

| Chandigarh | 04 | CH |

| Uttarakhand | 05 | UA |

| Haryana | 06 | HR |

| Delhi | 07 | DL |

| Rajasthan | 08 | RJ |

| Uttar Pradesh | 09 | UP |

| Bihar | 10 | BR |

| Sikkim | 11 | SK |

| Arunanchal Pradesh | 12 | AP |

| Nagaland | 13 | NL |

| Manipur | 14 | MN |

| Mizoram | 15 | MZ |

| Tripura | 16 | TR |

| Meghalaya | 17 | ML |

| Assam | 18 | AS |

| West Bengal | 19 | WB |

| Jharkhand | 20 | JH |

| Odisha | 21 | OR |

| Chattisgarh | 22 | CG |

| Madhya Pradesh | 23 | MP |

| Gujarat | 24 | GJ |

| Dadra And Nagar Haveli and Daman and Diu * | 26 | DD, DN |

| Maharashtra | 27 | MH |

| Andhra Pradesh | 28 | AP |

| Karnataka | 29 | KA |

| Goa | 30 | GA |

| Lakshadweep | 31 | LD |

| Kerela | 32 | KL |

| Tamil Nadu | 33 | TN |

| Puducherry | 34 | PY |

| Andaman and Nicobar Islands | 35 | AN |

| Telangana | 36 | TS |

| Andhra Pradesh | 37 | AP |

| Ladakh | 38 | LA |

| Other Territory | 97 | OT |

* The state code for UT of Daman and Diu was 25, prior to 26th January 2020.

What is GST state code 99 in GST?

99 state code is the central jurisdiction.

What is GST state code 97 in GST?

State code 97 is used for Other territory.

Other Territory includes territories other than States and Union Territories

(a) The Andaman and Nicobar Islands;

(b) Lakshadweep;

(c) Dadra and Nagar Haveli and Daman and Diu;

(d) Ladakh and

(e) Chandigarh

What is GST state code 01 in GST?

01 state code is use for Jammu & Kashmir.

What is GST state code 02 in GST?

02 state code is use for Himachal Pradesh.

What is GST state code 03 in GST?

03 state code is use for Haryana.

What is state code 04 in GST?

04 state code is use for Chandigarh.

What is state code 05 in GST?

05 state code is use for Uttarakhand.

What is state code 06 in GST?

06 state code is use for Haryana.

What is state code 07 in GST?

07 state code is use for Delhi.

What is state code 08 in GST?

08 state code is use for Rajasthan.

What is state code 09 in GST?

09 state code is use for Uttar Pradesh.

What is state code 10 in GST?

10 state code is use for Bihar.

What is state code 11 in GST?

11 state code is use for Sikkim.

What is state code 12 in GST?

12 state code is use for Arunachal Pradesh.

What is state code 13 in GST?

13 state code is use for Nagaland.

What is state code 14 in GST?

14 state code is use for Manipur.

What is state code 15 in GST?

15 state code is use for Mizoram.

What is state code 16 in GST?

16 state code is use for Tripura.

What is state code 17 in GST?

17 state code is use for Meghalaya.

What is state code 18 in GST?

18 state code is use for Assam.

What is state code 19 in GST?

19 state code is use for West Bengal.

What is state code 20 in GST?

20 state code is use for Jharkhand.

What is state code 21 in GST?

21 state code is use for Odisha.

What is state code 22 in GST?

22 state code is use for Chhattisgarh.

What is state code 23 in GST?

23 state code is use for Madhya Pradesh .

What is state code 24 in GST?

24 state code is use for Gujarat.

What is state code 26 in GST?

What is state code 27 in GST?

27 state code is use for Maharashtra .

What is state code 28 in GST?

28 state code is use for Andhra Pradesh .

What is state code 29 in GST?

29 state code is use for Karnataka.

What is state code 30 in GST?

30 state code is use for Goa.

What is state code 31 in GST?

31 state code is use for Lakshadweep.

What is state code 32 in GST?

32 state code is use for Kerela.

What is state code 33 in GST?

33 state code is use for Tamil Nadu.

What is state code 34 in GST?

34 state code is use for Puducherry.

What is state code 35 in GST?

35 state code is use for Andaman and Nicobar Islands.

What is state code 36 in GST?

36 state code is use for Telangana.

What is state code 37 in GST?

37 state code is use for Andhra Pradesh.

What is state code 38 in GST?

38 state code is use for Ladakh.